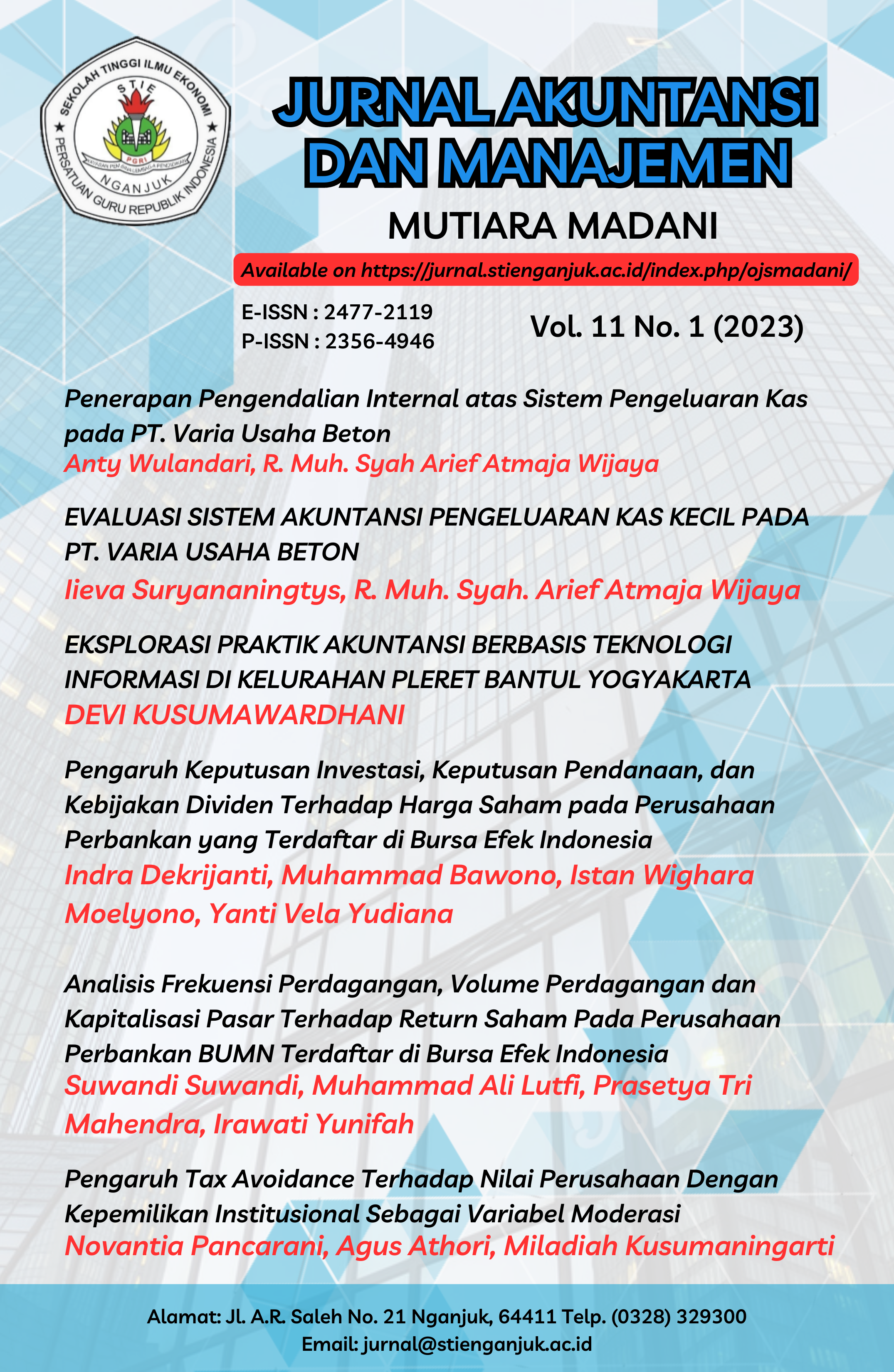

Analisis Frekuensi Perdagangan, Volume Perdagangan dan Kapitalisasi Pasar Terhadap Return Saham Pada Perusahaan Perbankan BUMN Terdaftar di Bursa Efek Indonesia

Abstract

This study aims to determine whether there is an influence on the return of banking stocks in the BUMN sector, which is seen based on trading frequency, trading volume and market capitalization. This type of quantitative research uses the event study method. The population and sample used are all BUMN banks listed on the Indonesia Stock Exchange. This hypothesis testing is a different test using the Wilcoxon Test, namely the Z test, through SPSS. The results showed that there was no significant influence between the frequency and volume of trading with stock returns, but market capitalization had a significant influence on stock returns. While simultaneously on the overall influence of independent variables on stock returns in BUMN banking companies.

The authors who publish this journal agree to the following conditions:

1. The author retains the copyright and gives the journal rights regarding the first publication with the work being simultaneously licensed under the Creative Commons Attribution License which allows others to share the work with acknowledgment of the author's work and the initial publication in this journal.

2. The author can enter separate additional contractual arrangements for non-exclusive distribution of the published version of the journal (for example, send it to an institutional repository or publish in a book), with an acknowledgment of its initial publication in this Journal.

3. Authors are permitted and encouraged to post their work online (e.g., at an institutional repository or on their website) before and during the submission process, as this can lead to productive exchanges, as well as excerpts of previously published works