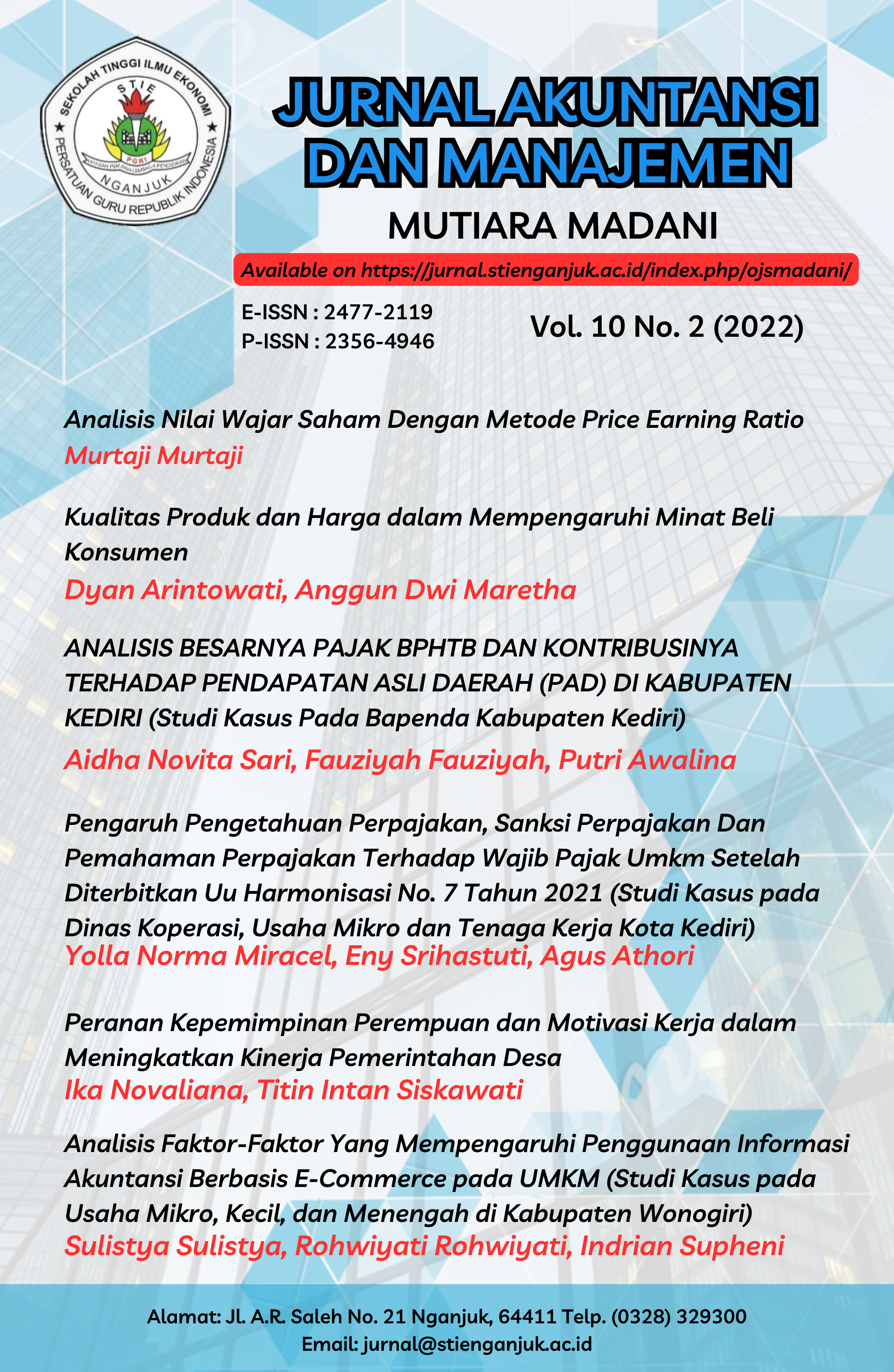

Pengaruh Pengetahuan Perpajakan, Sanksi Perpajakan Dan Pemahaman Perpajakan Terhadap Wajib Pajak Umkm Setelah Diterbitkan Uu Harmonisasi No. 7 Tahun 2021 (Studi Kasus pada Dinas Koperasi, Usaha Mikro dan Tenaga Kerja Kota Kediri)

Abstract

This research sought to determine the impact of tax knowledge, tax sanctions, and understanding of taxation toward taxpayers compliance on MSMEs after published of harmonization law number 7 year of 2021. The government stipulates a tax rate of 0.5% but on condition that the gross turnover in a year is less than Rp500 million, which is exempt from tax payments. So, MSME actors are only subject to tax if the turnover in one year is more than Rp500 million. Using the slovin formula and random sampling, this study had 100 participants. The data analysis techniques used multiple linear regression, and t test. The research found that knowledge of taxation and tax sanctions had no substantial impact on MSMEs taxpayer compliance. Meanwhile, the understanding variable has a substantial impact. The result of the determinant coefficient calculation is 0.293, which indicates that only 29.3% of taxpayer compliance is influenced by tax knowledge, tax sanctions, and tax understanding, with the other 70.7% being influenced by other variables not examined in this study.

The authors who publish this journal agree to the following conditions:

1. The author retains the copyright and gives the journal rights regarding the first publication with the work being simultaneously licensed under the Creative Commons Attribution License which allows others to share the work with acknowledgment of the author's work and the initial publication in this journal.

2. The author can enter separate additional contractual arrangements for non-exclusive distribution of the published version of the journal (for example, send it to an institutional repository or publish in a book), with an acknowledgment of its initial publication in this Journal.

3. Authors are permitted and encouraged to post their work online (e.g., at an institutional repository or on their website) before and during the submission process, as this can lead to productive exchanges, as well as excerpts of previously published works